FY 23 – Portfolio Reflections*

What Worked:

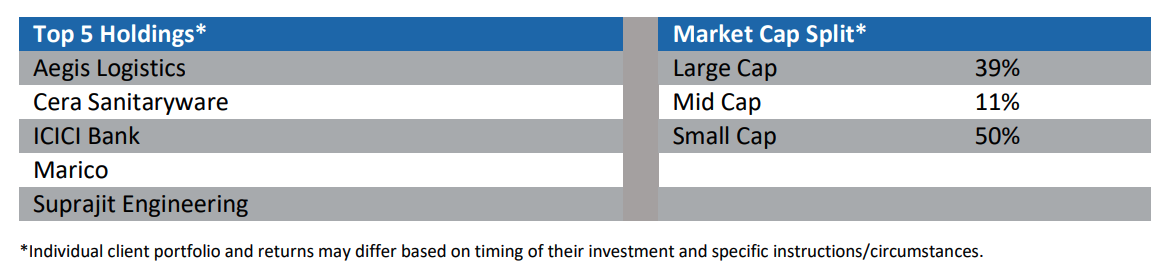

Aegis Logistics – With an 84% appreciation, Aegis was the best performing stock in the portfolio during FY23. Post the JV formation with Vopak (market was worried Aegis sold too cheap) and the unfortunate demise of one of the promoters in 2021, the stock sold off. However, accretive acquisitions in the liquid business and the completion of the Kandla gas terminal allowed Aegis to grow the significantly more profitable commercial and retail gas distribution business. With a 9MFY23 segment profits growth for the gas and liquid division of ~40% and ~30% respectively, the company remains on track to deliver 25%+ earnings growth over the next 3-4 years through better asset utilization and ongoing projects which should aid throughput gas volumes and profitability.

Cera Sanitaryware – Through FY23, Cera’s stock price rose by ~30%. Despite supply chain uncertainties and high freight rates negatively impacting its competitors, Cera managed to grow its market share without any stock outs by operating its plants at >100% capacity. In May 2022, Cera announced a plan to increase the capacity of its faucet ware and sanitaryware businesses with an internally funded investment of Rs200crs. This strategic move is expected to result in further growth and margin expansion over the next few years due to benefits of scale and a premium product mix. We admire Cera’s focus on its core business and its commitment to retail channel-led growth and expect margin expansion to continue and profits to grow at >20% for the next couple of years.

What Didn’t Work (and Looking Attractive):

ICICI Lombard General Insurance – ICICI Lombard had a tough year in FY23, with a 19% decline in its share price, which negatively impacted the portfolio performance. The company’s heavy reliance on the auto insurance sector, which represents 50% of its business, was impacted by heightened competition and aggressive pricing from digital/unlisted players. Despite being selective and vigilant, ICICI Lombard experienced rising underwriting losses in this segment, while rising strategic investments in health insurance also affected overall profitability. The company however achieved a 30% profit growth over FY22 and 17% over FY21 through prudent investment and treasury operations. Nevertheless, in the face of competitive pressures and higher regulatory changes, the stock has derated from 52x PE in April 22 to 30x presently. Competition is showing early signs of easing. ICICIGI’s strategic investments in expanding distribution channels and presence in other lines of business, coupled with a strong balance sheet and industry-leading RoEs, should yield long-term dividends.

IT Services Pack – Our holdings in TCS (-14%), Infosys (-25%) and L&T Tech Services (-34%) corrected sharply in FY23 in the wake of economic uncertainties amid rising interest rates and inflation. While these businesses continue to grow, there is a slowdown as their customers reassess IT spending needs and take stock of discretionary costs. With the funding crisis in the US banking system leading to a ‘bail out’ of Silicon Valley and other regional banks and Credit Suisse in Europe, the near-term outlook continues to remain challenging. These businesses, however, remain best in class on balance sheet strength and return ratios and should bounce back once normalcy returns. With an impending US slowdown, we continue to closely monitor developments here.

Looking Ahead

The pessimist sees difficulty in every opportunity. The optimist sees the opportunity in every difficulty.

– Winston S. Churchill

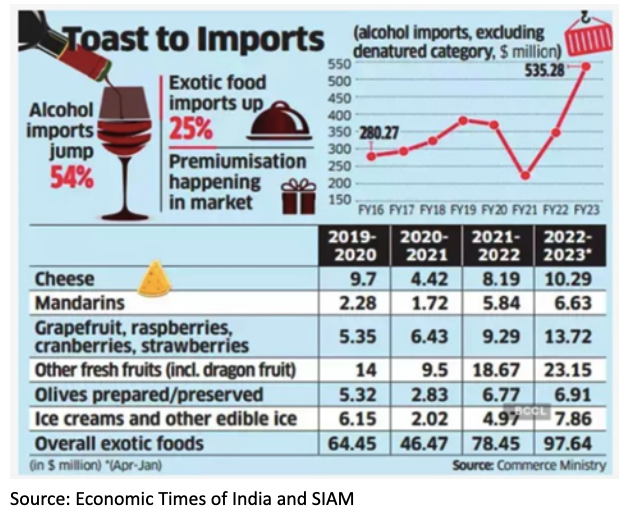

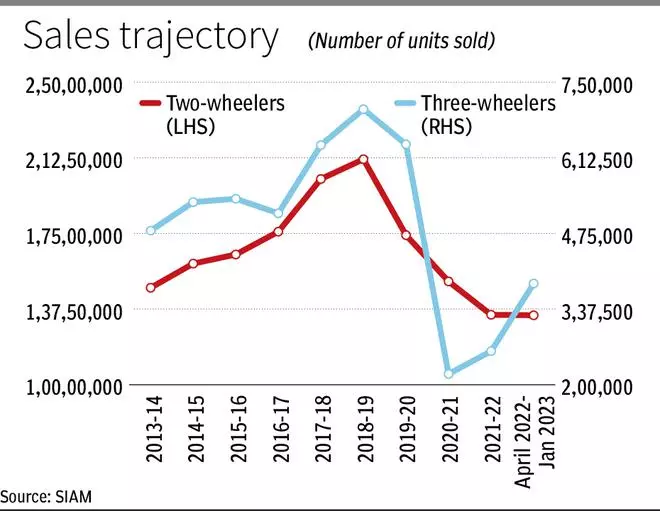

India’s economic recovery post the Covid lockdowns appears to be K-shaped, with rural consumers yet to see a real upturn from the lows due to rising inflation and lackluster job growth, despite the government’s infrastructure efforts and the provision of free grains to over 80 crore citizens every month. As the table below shows, imports of high-end foreign goods in India have accelerated since covid. Companies like Phoenix Mills are experiencing a significant recovery in urban consumption, with sales up 20% from 2020 levels and real estate developers like DLF and Lodha recording high volumes of pre-bookings and sales. Hindustan Unilever, Marico, Tata Consumer and other FMCG companies’ management teams attribute the slight improvement in rural India’s numbers over the past few months to tapering inflation, and there seem to be some green shoots of recovery. Two-wheeler sales are also showing early signs of an uptick after nearly a decade.